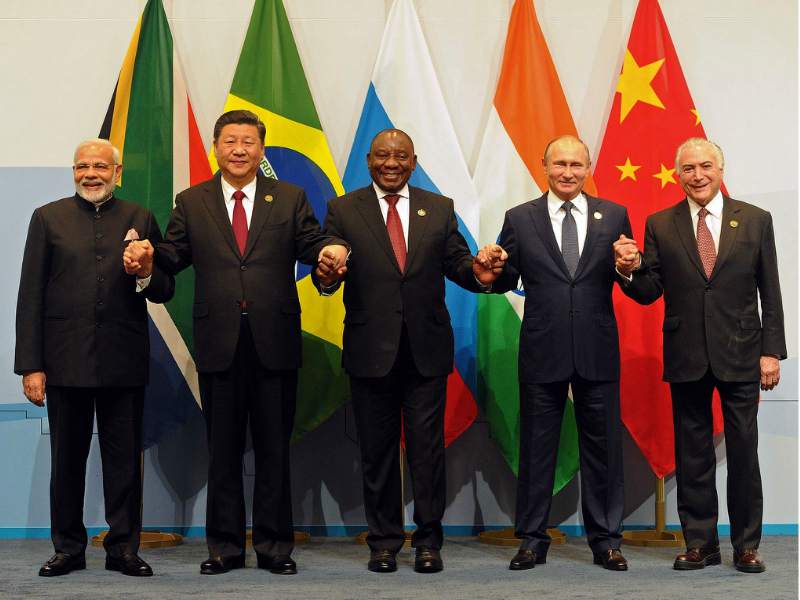

As the U.S. dollar’s status as the world’s reserve currency continues to erode, countries around the globe are preparing for a future without its influence. One of the most visible and powerful groups seeking to reduce their reliance on the dollar is the BRICS (Brazil, Russia, India, China and South Africa). Through a variety of tactics including trading agreements, gold purchases, and reserve diversification efforts, these nations are leading the charge in what has been dubbed “de-dollarization” – an effort to reduce their dependence on the US currency system.

The US dollar has been the dominant global reserve currency since World War II; however, its preeminence is starting to weaken. Since 2017 there has been a marked increase in de-dollarization efforts by nations who are feeling stifled by American economic sanctions or other foreign policy decisions that have weakened their ability to do business with one another in US dollars. As part of this shift away from US dominance several countries – especially within BRICS – have sought new ways of doing business that rely less heavily on American currency.

One popular example of de-dollarization is the use of alternative payment systems such as Russia’s MIR card or China’s UnionPay system. These systems provide users access to international commerce without having to go through dollar denominated transactions or rely on American banking infrastructure which could be subject to sanctions or restrictions if needed.

Another way that BRICS nations are reducing their dependence on US dollars is through gold purchases. This can be seen in China and Russia both increasing their gold reserves by significant amounts over recent years – particularly in 2020 when both countries significantly increased their gold holdings due to market volatility caused by Covid-19 pandemic and geopolitical uncertainty between them and western countries. As more gold enters circulation it will create additional liquidity which can then be used in international transactions rather than relying on fiat currencies like US dollars or Euros which could be subject to manipulation or interference from outside forces like political pressures or sanctions.

Finally, BRICS nations are also diversifying their foreign exchange reserves away from USD based assets towards commodities such as oil, natural gas and various metals like copper which can be used as hedges against market volatility instead of just relying on paper money. In addition they have also talked about creating a common digital currency backed by gold that all members would use for trade purposes – but as of yet this proposal has not come into fruition .

De-dollarization is an important trend that will shape global markets for years to come and its already becoming clear why BRICS nations have taken up so much of this effort – namely because it allows them greater control over their own financial destiny while simultaneously weakening any potential influence from external forces like Washington D.C.. While it may still take time for other countries around the world (especially those outside of BRICS) take up similar practices due ,it's clear that de-dollarization among BRIC nations will remain an ongoing trend throughout 2021 and beyond .