Are you one of the millions of investors who rely on professional fund managers to make your money grow? According to a recent series of studies, the odds are not in your favor.

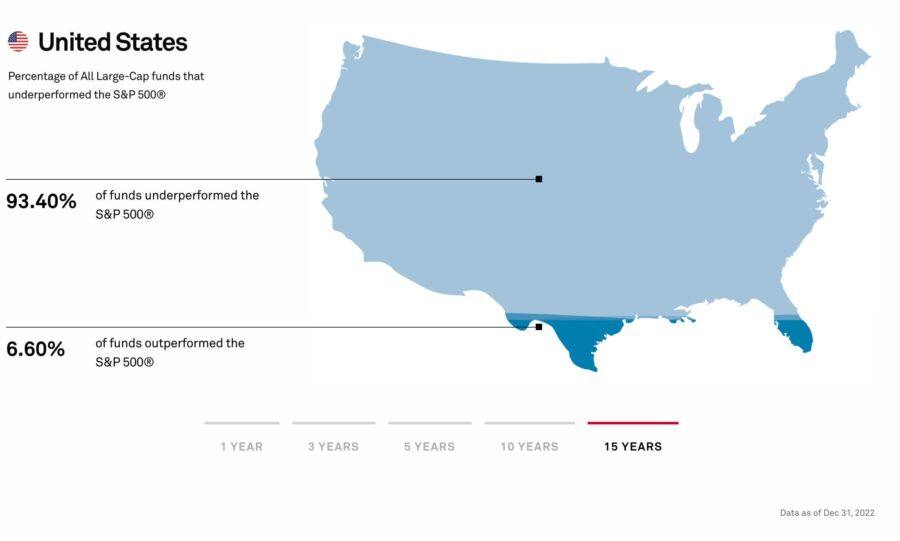

In fact, according to the SPIVA (Standard & Poor's Index vs. Active) scorecard for 2022, over 93% of actively-managed U.S. equity funds failed to match their respective S&P benchmarks over a 15-year period of time. That's right - despite their best efforts, the vast majority of supposedly "professional" fund managers couldn't even keep pace with the performance of a simple index fund.

Based on this data, collected over multiple decades and updated every 6 months, it is clear the average investor would be better served to simply buy index funds in the form of SPY, QQQ, or DIA than to invest with the so-called "professionals".

So why do so many investors continue to place their trust in these underwhelming fund managers? The answer is simple: we're conditioned to believe that active management is the only way to secure strong investment returns.

But what if there was a better way?

Taking Back Control of Your Money

What if you could beat the S&P 500 while still enjoying the benefits of a professionally managed portfolio?

Well, now you can. Thanks to modern investment options, even an ordinary person at home can manage their money as well as or better than a professional.

For about the past 80 years, the most common method for an ordinary person to access a well-rounded investment portfolio has been by using a fund manager who invests their funds in a variety of mutual funds.

Mutual funds function by pooling money from a group of investors and using it to buy various stocks, bonds, and other securities. These investments are managed by a professional fund manager who is responsible for diversifying the portfolio to minimize risk and maximize returns.

The idea was that by investing in a range of assets, the risk would be spread out and the returns maximized. However, as the SPIVA scorecard for 2022 has shown, this method has largely failed to deliver on its promises. In fact, over 93% of actively-managed U.S. equity funds have not been able to beat their respective S&P benchmarks.

This failure has caused many investors to question the value of using mutual funds and the supposed expertise of fund managers. Fortunately, modern investment options have emerged that allow individuals to take back control of their finances and achieve better returns with minimal effort.

The Mutual Fund of the Future

In case you missed it, over the last 20 years a new type of fund has become incredibly popular... The ETF (short for Exchange Traded Fund).

ETFs are rapidly gaining in popularity and are frequently touted as the mutual fund of the future. Their ease of trading, low costs, transparency, and flexibility make them an attractive option for investors looking for a cost-effective and efficient way to invest in the stock market.

ETFs are like a basket of investments that you can buy and sell like a stock. They usually track a specific stock market or industry and hold a bunch of underlying assets such as stocks or bonds.

Here's the best part... ETFs are traded on an exchange like a stock, making them easy to buy and sell. Unlike mutual funds, ETFs do not carry as many fees and they can easily be managed by a less experienced trader at home.

This distinction makes ETFs a good way to invest in a certain market or sector, and the fact that they are easy to trade makes them popular among investors.

What's the Cost Benefit?

The cost of maintaining an ETF portfolio is significantly lower than that of a mutual fund. ETFs have no entry or exit fees like mutual funds, which means you can enter and exit the market with minimal cost.

Additionally, ETFs are transparent and track their underlying index closely, making it easier for investors to monitor their performance over time.

Most importantly, you can say goodbye to those pesky management fees charged by your "professional" money manager. What could that be worth?

Management fees usually range from 1-2% of the funds under management, and you still have to pay them even if your fund manager doesn't perform well. That's why the SPIVA study is essential because it shows that over 93% of fund managers can't match the performance you could get by purchasing the S&P500 ETF (SPY) and holding it for 15 years.

If you have an account with $100,000, the management fee of 2% would be around $2,000 per year. However, for an account with $1,000,000 the fee would be much higher at $20,000 per year. This fee is paid to a fund manager who is statistically unable to surpass the market.

How You Can Start Managing Your Money With ETFs

If you're interested in learning how to invest in ETFs without paying exorbitant fees to a fund manager, you won't want to miss the Raging Profits with ETFs challenge put on by Trade Maestro. This free 3-day challenge is designed to teach you everything you need to know about ETFs, from choosing the right funds to understanding how to allocate your portfolio effectively.

By the end of the challenge, you'll feel empowered with the knowledge and tools to invest in ETFs confidently and take control of your own financial future. So why wait? Sign up for the Raging Profits with ETFs challenge today and start your journey toward financial freedom!